Markup (business)

What is Markup?

Markup is the amount of value added to the cost of the product in order to sell it. In other words, it’s the difference between the selling price and the cost and it is often expressed as a percentage over the cost.

People regularly confuse Markup and Gross Margin, even those senior professionals with many years of experience in business. Yet, difference between those two is very important and confusing those two can cause profitability problems as we will see in the example below. But first things, first; let’s see the calculation formula of Markup.

Calculation Formula

Example

Selling Price / Unit: $15

Cost / Unit: $10

Units: 100 PCs

Calculation:

Net Sales: 100PCs x $15 = $1,500

Cost of Goods Sold: 100PCs x $10 = $1,000

Markup (%): ($1,500 – $1,000) / $1,000 = 50%

Markup vs Gross Margin

Basically, the difference in the calculation of those two formulas (Markup vs. Gross Margin) is the denominator. In the case of Markup, the denominator is the COGS (Cost of Goods Sold) and in the case of Gross Margin, it is the Net Sales. Hence, when we calculate the Markup, we examine the profitability in terms of price difference over the cost of the products sold. On the other hand, in gross margin, we evaluate the profitability over our sales revenues.

Now that we have analyzed the difference in the calculation and meaning of those two business metrics, it’s time to see why it is important to always use the Gross Margin. We will explain it with an example to demonstrate the profitability problem that use of Markup can cause:

Let’s suppose that we have bought a product at $100 and we decide to increase the price by 10% in order to sell it. So, the selling price becomes:

$100 x (100% + 10%) = $110.

Now let’s assume that after a couple of weeks, we haven’t sold our product yet and we decide to discount it. We decide that we would like to discount it 10%, supposedly that will bring the price back to the cost, since we have increased the price by that same percentage. Let’s see the calculation:

$110 x (100% – 10%) = $99.

So, as we see, instead of getting back to $100, we get to $99 which is slightly below our cost.

Therefore, we see that using the markup formula to decide the pricing of our products will cause errors in our profitability calculations and will lead to decreased profit margins (or even losses). So let’s get back to our example and see what would be the correct way.

Using the Gross Margin formula to decide what our selling price (SP) would be, we end up at:

$100 / (100% – 10%) = $111.11.

When at later time we decide to discount it by 10% we get back to our cost:

$111.11 x (100% – 10%) = $110.

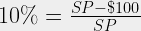

Here is the full series of calculations to find the Selling Price (when we know our cost & gross margin):

Symbols:

GM% → Gross Margin%

SP → Selling Price

BP→ Buying Price

So, in our example the formula becomes:

Symbols:

GM% → Gross Margin%

SP → Selling Price

BP→ Buying Price

So, in our example the formula becomes:

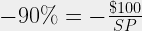

Doing some simple math:

Doing some simple math:

Solving for SP we get to:

SP = $100 / 90% → $111.11

Solving for SP we get to:

SP = $100 / 90% → $111.11